Student’s Name

Department, Institutional Affiliation

Course Code: Course Title

Professor’s Name

Due Date

Executive Summary

A simulation game project mimics real-world activities and helps in teaching without the player incurring actual risks. The goal of this game project was to trade on Stock Track as a market simulation. Stocktrak is a website that provides users with a platform to learn more about portfolio investment using different securities such as bonds, stocks, and equities from different sectors in the economy. The simulation was for a period of three months, from 22nd August to 21st November. It involved trying out different types of investment instruments, which would help to gain knowledge on the different trading strategies and the advantages and disadvantages of each. During the simulation period, I opted for less risky instruments, especially equity. I got buy recommendations from Stock Track, which guided me on which equities to buy. My decision to buy was also guided by analysts’ consensus recommendation. I traded only with US dollars during the simulation.

Table of Contents

Trading Experiences

I am not an expert in trading, so I got into this simulation with some anxiety about the best investment decision during this simulation. I was interested in creating an investment portfolio that would help me to generate income. I decided to take a low-risk strategy. I understand that the higher the risk, the higher the returns, but since I do not have much experience in trading, I decided to follow this strategy. I had also heard about managing emotions in trading to avoid making costly mistakes, so I tried to ensure that I kept my emotions in check. Unfortunately, I made losses from most of my investments. I made a profit from 20 of the investments and made losses from the rest. I made losses in all the mutual funds, and from the losses, I learned the importance of doing research in order to identify the most promising companies to invest in. Another lesson I learned was to take risks when investing. I took low risks during investment and focused on the investments that were not too risky

My Portfolio

My portfolio consisted of 87 financial assets, which consisted of four bonds, three mutual funds, one future option, and 69 equities/ stocks. It was an income portfolio whose primary objective was to secure regular income. Through the stocks, for example, I hoped to gain income from dividends. Stocks are a part of the ownership of a company whereby investors get to own the company proportionally to the number of shares they own. Whenever the companies make profits, I expect to receive some dividends as a source of income. Moreover, with the companies’ good performance, I expected that I could sell the stocks for a higher price. I also invested in bonds, which are a form of loan in which, upon maturity, the investor returns the principal amount and the interest. The bonds were also a source of income but a diversification of risk. I bought the bonds to keep the money safe until a certain maturity date when the principal amount would come back with interest. The 21ST CENTY FOX AMER INC – 6.400% – Dec 2035 will be due in 2035 when I am to get a 6.4% interest on my initial investment. ABBOTT LABS – 6.000% – Apr 2039 will be due in 2039, where my investment will accumulate a 6% interest. T-BOND 6.000% 15-Feb-2026 is a T-bond. T-bonds are government debt securities that are issued by the US federal government. The bonds mature over a period between 20 to 30 years and earn periodic interest until they mature.

The other alternative investments I opted for were future options and mutual funds. Investing in mutual funds was a way of further diversifying the risk. Mutual funds are a portfolio of investments whereby all investors own a portion of the entire fund. A mutual fund enables owners to access a broad range of investments at a lower risk. Through the mutual fund, I can earn dividends and interest income as part of my income-earning strategy. The first mutual fund I invested in was VSMPX (Vanguard Total Stock Market Index Fund Institutional Plus Shares), which gives investors access to the US equity market. I also invested in VANGUARD GROUP, which is the largest provider of mutual funds across the globe. The other mutual funds I invested in were FIDELITY GROWTH CO FUND and Van Ttl St MkId Institutional Plus Shs. Finally, I invested in future options. I invested in e-Mini S&P 500 (Globex) 12/2024 5300 PUT. Future options are speculative and advanced strategic investment options where the holder has the flexible option to buy or sell an asset.

Netflix Company Analysis

One of the companies I chose to invest in is Netflix Inc. Netflix is a world-renowned entertainment company that provides viewership content to audiences. It was incepted in 1996 as a mail-in DVD business and continued to disrupt itself to provide different services in response to shifting consumer needs in the entertainment industry. Since it began its pure streaming services in 2007, Netflix has expanded to provide streaming entertainment to more than 190 countries worldwide. The streaming platforms provide a variety of entertainment, such as films, series, games, and videos. Members pay a subscription fee, which is the company’s primary source of revenue. So far, Netflix has over 280 million subscribers, which has cemented its market position. Subscribers can access content through a series of internet-connected devices, including smartphones, laptops, and tablets. They can then watch movies at their convenience and can pause and resume watching on a need basis. The streaming giant offers a diversified range of high-quality programs, which has helped it to differentiate itself from its rivals.

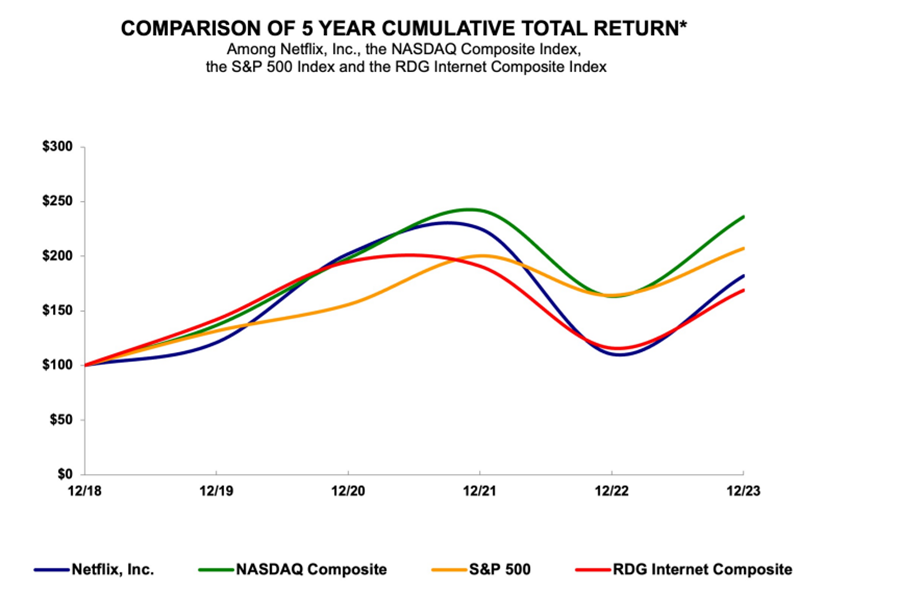

Netflix operates in a fiercely competitive market with others who offer similar services, as well as other entertainment video providers. The company reports that its viewership is highly seasonal, going up between October and March and slowing down the rest of the year. Currently, Netflix has been working on cracking down on password sharing to encourage more subscriptions and achieve revenue expansion. Netflix trades its common stock at the NASDAQ global select market. Its ticker symbol is NFLX. By the end of the 2023 financial year, Netflix reported an estimated 2,728 stockholders for its common stock. However, the company has never declared a dividend and has declared that it does not anticipate paying any cash dividends to its stockholders in the foreseeable future. Netflix’s stock performance over the last five years is as follows:

Fig 1:

Netflix Stock Performance between 31.12.208 and 31.12.2023

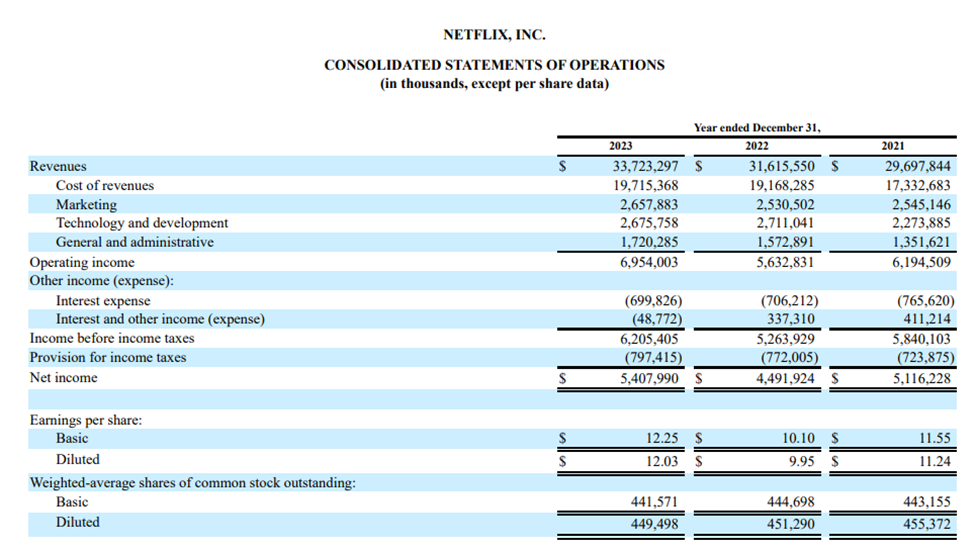

According to the company’s financial statements, revenue went up from $31,615.55 million in 2022 to $33,723.297 million in 2023 (Netflix, 2024). The majority of this was from streaming revenues, while the rest was from DVD revenues. The monthly membership fees for streaming content vary from country to country and depend on the features of the plan offered. The United States and Canada were the biggest markets, followed by Europe, the Middle East, Africa, and Latin America in third position. The Asia-Pacific market is the least-performing market. Netflix does not operate in the Chinese market due to licensing restrictions. The company’s net income for the year ended 2023 was $5,407.99 million compared to $4,491.924 million for the year ended 2022 (Netflix, 2024). This indicates that the company is recording increased profitability, which is a positive report for current and potential investors.

Basic Earnings per share in 2023 were $12.25 in 2023 compared to $10.10 in 2022, while diluted earnings per share were $12.03 and $9.95 in 2023 and 2022, respectively. The weighted average shares of common stock outstanding were $441.571 million and $444.698 million for the years ended 2023 and 2022, respectively (Netflix, 2024).

Fig 2:

Netflix Balance Sheet for Financial Year ended 2023

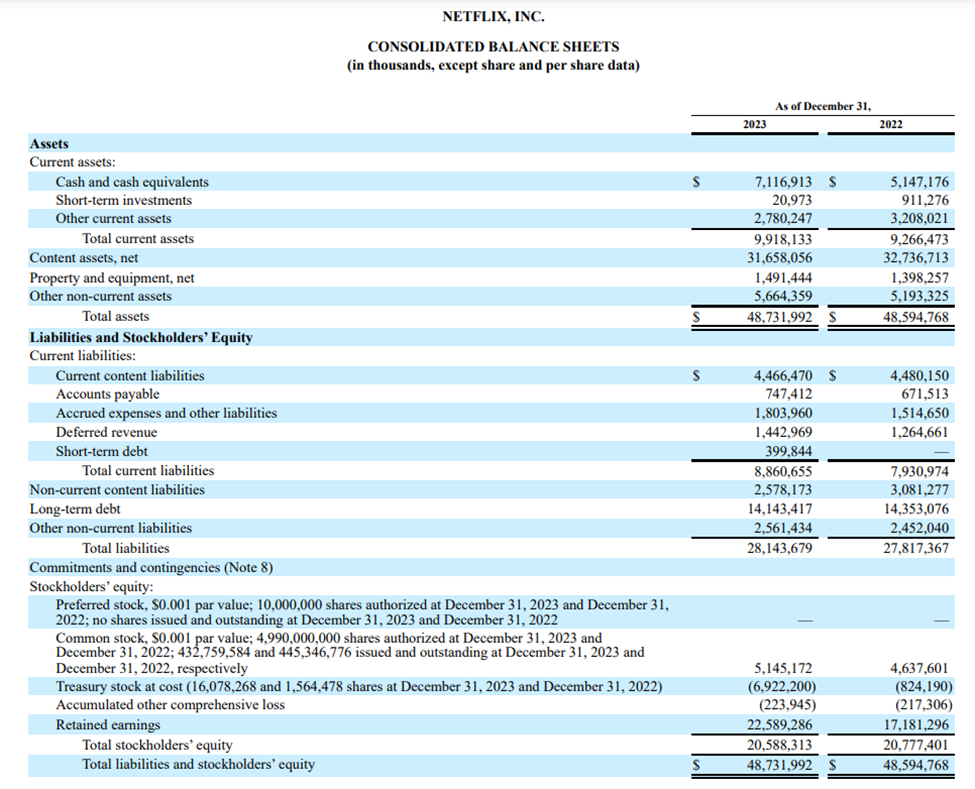

According to Netflix’s balance sheet, the company’s total assets were $48,731.992 million and $48,594.768 million in 2023 and 2022, respectively. Current assets during these periods were $9,918.13 and $9,266.473 respectively. The increase in current assets was largely due to an increase in cash and cash equivalents 9including money market funds and time deposits), as short-term investments dropped significantly from $911.276 million in 2022 to $20,973 in 2023. There was a slight increase in liabilities from $27,817.367 million for the year ended 2022 to $28,143.679 million for the year ended 2023. Netflix had no short-term debt in 2022, but it went up to $399.844 million in 2023. Accounts payable accrued expenses and deferred revenue also went up during the 2023 financial year (Netflix, 2024).

Fig 3:

Why buy Netflix?

The reason Netflix was selected as a buy was due to an analysis of its financial ratios, which indicated that the company has a robust financial performance and will have positive returns in the future. Netflix’s current ratio for the year ended 2023 is 1.1, which indicates stable liquidity and that it can comfortably meet its short-term obligations. A storing liquidity position is a green flag for investors as it shows positive performance. Its long-term debt capital is 0.4072. The long-term debt capital helps investors understand the level of risk in a company (Bordeianu & Radu, 2020). A ratio below 0.5 is ideal as it indicates that the company has enough capital or equity to cover its liabilities. A 0.4 long-term debt-capital ratio is thus an indication of fair leverage. Another ratio that investors use to assess a company’s leverage and overall financial health is the debt-to-equity ratio, which shows the ratio of a company’s shareholders’ equity to its total liabilities. A ratio above 2 is a cause of concern as it shows the company has more debt compared to equity. For the year ended 2023, Netflix’s debt-to-equity ratio was 0.7, which shows that it is not too indebted, which is a green flag for investors.

Another critical ratio that investors consider before investing is the return on equity ratio. ROE shows how well a company uses shareholders’ investment in profit generation. A high ROE indicates high efficiency in generating income from equity financing (Bordeianu & Radu, 2020). Netflix has an ROE of 26.265, which is way above the generally recommended 15% to 20%. For every dollar invested in the company, Netflix generates a return of $0.26, which is a good return. A company’s ROA (Return on Assets) shows how well a company is performing and how well it generates income relative to its total assets. The higher the ROA, the more efficient a company is at generating profit from its assets. Netflix has a ROA of 11.09%, which is an average performance. The ROI (Return on Investment) for the same period was 15.57%.

An ROI is an important ratio that helps investors analyze an investment opportunity and predict whether it will be a high-performing or low-performing investment. Netflix’s ROI is a positive indicator to investors that the company is being properly managed, making it a good company to invest in. An additional critical ratio is the Free Cash Flow (FCF) ratio, which helps investors analyze a company’s financial health by showing the amount of cash available to support its operations (Bordeianu & Radu, 2020). Netflix’s FCF rose steadily from 3.87 in 2022 to 11.82 in 2023. This shows that within the year, the company had more cash left over after paying for its capital expenditures and operating expenses. The improvement in liquidity is an indicator of positive financial performance and is a green flag for an investor.

Conclusion

Overall, the simulation game project provided me with a unique opportunity to gain insight into real-world trading experiences. It was an opportunity for me to immerse myself in trading without the pressure of actual risks. Through the simulation, my critical thinking and decision-making skills were sharpened. I learned the importance of conducting in-depth research into companies before investing or purchasing stocks and bonds. For instance, Netflix, as highlighted above, is a good-performing company. However, the company does not intend to give dividends; hence, it is not ideal for an income-oriented portfolio. It would, however, be good for a growth-oriented portfolio. Another lesson was not to be too risk-averse as it could lead to me missing out on potential earnings from high-risk investments. The third lesson I picked up from this simulation is to diversify the portfolio more. The majority of the portfolio consisted of equities. Diversification to a bigger number of alternative investments is better for spreading out risk and, in return, generating more income.

Unfortunately, from this game project, I lost money rather than made money. This can be attributed to buying into equities that I then sold at lower prices, hence making losses. Admittedly, thorough research of such a high number of investments may have been difficult within such a short time, so next time, more time should be dedicated to proper research. The game project also helped me discover a variety of financial analysis tools and websites that can make it easier to make an accurate assessment of a company’s performance as well as other investment instruments.

References

Bordeianu, G. D., & Radu, F. (2020). Basic Types of Financial Ratios Used to Measure a Company’s Performance. Economy Transdisciplinarity Cognition, 23(2).

Netflix (2024). Netflix Form 10-k report 2023. Retrieved from https://s22.q4cdn.com/959853165/files/doc_financials/2023/ar/Netflix-10-K-01262024.pdf

Cite this article in APA

If you want to cite this source, you can copy and paste the citation below.

Antony Lawrence. (2024, November 29). Final Stock Market Simulation Reflection. EssayHelper.me. Retrieved from https://essayhelper.me/essay/final-stock-market-simulation-reflection/